Let’s discuss the question: 62000 a year is how much a month after taxes. We summarize all relevant answers in section Q&A of website Abettes-culinary.com in category: MMO. See more related questions in the comments below.

How much is 62000 a year take home?

$62,000 after tax is $62,000 NET salary (annually) based on 2022 tax year calculation. $62,000 after tax breaks down into $5,167 monthly, $1,188 weekly, $237.65 daily, $29.71 hourly NET salary if you’re working 40 hours per week.

How much per hour is 62000 a year?

If you make $62,000 per year, your hourly salary would be $31.79. This result is obtained by multiplying your base salary by the amount of hours, week, and months you work in a year, assuming you work 37.5 hours a week.

How To Calculate Federal Income Taxes – Social Security \u0026 Medicare Included

[su_youtube url=”https://www.youtube.com/watch?v=ieA-bmoFk3k”]

Images related to the topicHow To Calculate Federal Income Taxes – Social Security \u0026 Medicare Included

What is my take home pay if I make 60000 a year?

If you make $60,000 a year living in the region of California, USA, you will be taxed $14,053. That means that your net pay will be $45,947 per year, or $3,829 per month.

What is 62000 a year after taxes Texas?

If you make $62,000 a year living in the region of Texas, USA, you will be taxed $11,371. That means that your net pay will be $50,630 per year, or $4,219 per month. Your average tax rate is 18.3% and your marginal tax rate is 29.7%.

How much income tax do you pay on 62000?

If you make $62,000 a year living in the region of Alberta, Canada, you will be taxed $19,168. That means that your net pay will be $42,832 per year, or $3,569 per month. Your average tax rate is 30.9% and your marginal tax rate is 34.8%.

Is 62000 a year good?

Is $60,000 a year a good salary? $60,000 per year is a really good salary to live comfortably on. However, everyone’s situation and finances are different.

How much is $35 an hour annually?

| $35 An Hour | Total Income |

|---|---|

| Yearly (52 weeks) | $72,800 |

| Yearly (50 weeks) | $70,000 |

| Yearly (262 Work Days) | $73,360 |

| Monthly (175 Hours) | $6,125 |

How much per hour is 65000 a year?

Earning $65,000 a year means you’re making $31.25 per hour.

How much is 60000 a year per hour?

To calculate the hourly rate, you divided the total pay—$60,000—by the number of hours worked— 1,920. The answer to this calculation comes out as $31.25 per hour. However, you may also be wondering, $60k a year is how much a week? To get the weekly rate, multiply the hourly rate by the number of hours worked.

Will I get a tax refund if I make 60000?

What is the average tax refund for a single person making $60,000? A single person making $60,000 per year will also receive an average refund of $2,593 based on the 2017 tax brackets. Taxpayers with a $50,000 or $60,000 salary remain in the same bracket.

Is 60k a year middle class?

Statisticians say middle class is a household income between $25,000 and $100,000 a year. Anything above $100,000 is deemed “upper middle class”.

Is 66000 a good salary?

A salary of $65,000 can be a high income in many parts in the United States but below average in other parts. The cost of living can vary greatly between different areas, because of fluctuations in housing prices and availability, insurance pricing, healthcare costs, food pricing and availability and more.

How much I pay in taxes on a $163,800 per month income

[su_youtube url=”https://www.youtube.com/watch?v=V9X30VkLRtY”]

Images related to the topicHow much I pay in taxes on a $163,800 per month income

How do I calculate my monthly income after taxes?

To calculate the after-tax income, simply subtract total taxes from the gross income. It comprises all incomes. For example, let’s assume an individual makes an annual salary of $50,000 and is taxed at a rate of 12%.

What is my net income after taxes?

You may also see the term “net income” when filing income taxes. You can calculate it using information from your federal tax return. Take your taxable income listed on your Form 1040 (Line 10 for 2018) and then subtract your total tax (Line 15). The result is your net income based on your tax return.

How much is social security tax?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How much tax do I pay on 62000 in Ontario?

If you make $62,000 a year living in the region of Ontario, Canada, you will be taxed $17,558. That means that your net pay will be $44,443 per year, or $3,704 per month. Your average tax rate is 28.3% and your marginal tax rate is 34.2%.

How much tax do I pay on 67000 in Ontario?

If you make $67,000 a year living in the region of Ontario, Canada, you will be taxed $19,176. That means that your net pay will be $47,824 per year, or $3,985 per month. Your average tax rate is 28.6% and your marginal tax rate is 29.7%.

How much does 63000 get taxed?

If you make $63,000 a year living in the region of California, USA, you will be taxed $15,257. That means that your net pay will be $47,743 per year, or $3,979 per month.

How much is 65k a year monthly?

| Type of Income | Amount Paid |

|---|---|

| Annual Income (2,080 Hours Paid) | $65,000 |

| Monthly Income (Annual / 12 Months) | $5,417 |

| Biweekly Income (Annual / 26 pay cycles) | $2,500 |

| Weekly Income (Annual / 52 work weeks) | $1,250 |

How much do you make a month if you make 60000 a year?

Annual Salary of $60,000 ÷ 12 months = $5,000 per month

This is how much you make a month if you get paid 60000 a year.

What is considered middle class in GA?

Georgia’s household income range for the middle class is $23,948 – $114,234. The state’s median family income is the 18th lowest in the country at $74,833. The Peach States has the 7th lowest middle-class share of income in the nation at 45.4%.

What is 68000 a year hourly?

If you make $68,000 per year, your hourly salary would be $34.87. This result is obtained by multiplying your base salary by the amount of hours, week, and months you work in a year, assuming you work 37.5 hours a week.

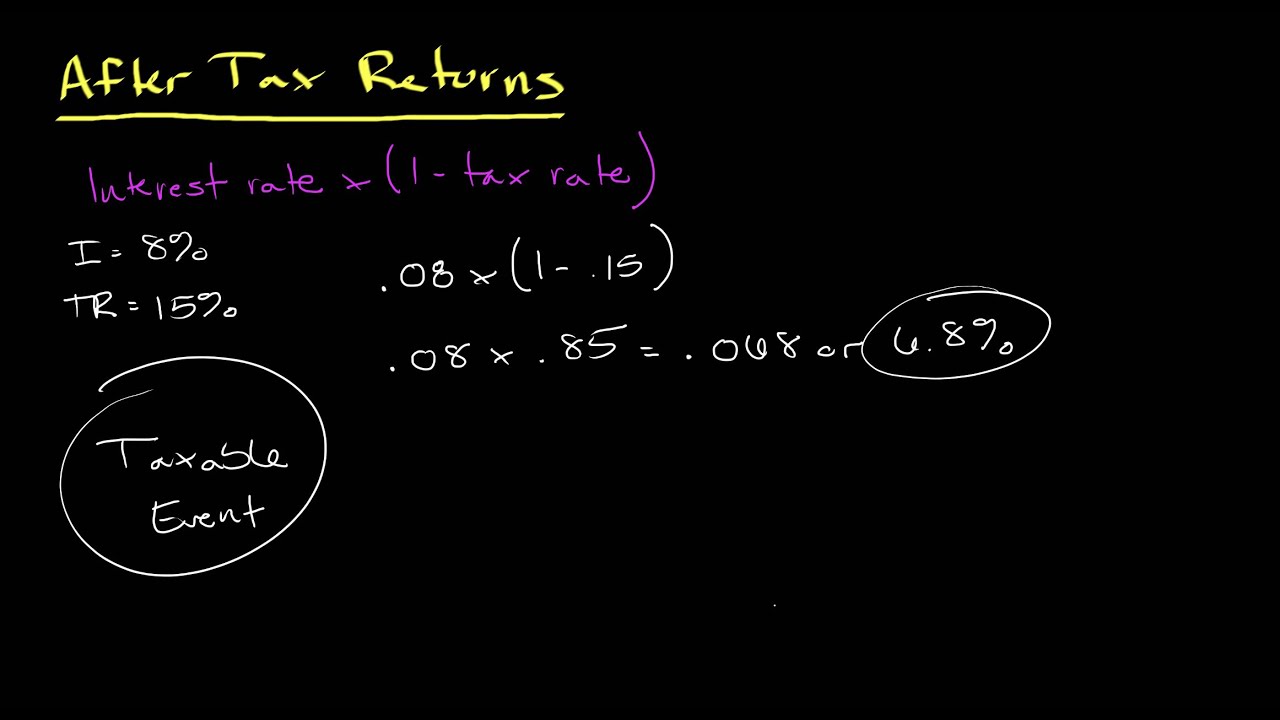

Calculating After Tax Returns | Personal Finance Series

[su_youtube url=”https://www.youtube.com/watch?v=eY1YM5lxJW4″]

Images related to the topicCalculating After Tax Returns | Personal Finance Series

Is 35 an hour good money?

Is $35 an Hour a Good Salary? Making $35 an hour will put you in one of the higher tiers of income among Americans. Only ~30% of household incomes make more than the $66,560 salary that $35 an hour provides.

Is 70k a year good salary?

Whilst earning $70,000 a year puts you well above the national average median salary of $53,490, whether it’s a good salary or not will depend on your lifestyle choices, your debt, and your expectations. Earning 70k a year is considered middle class income in America.

Related searches

- how much is 200k a year monthly after taxes

- how much is $65 000 a year after taxes

- tax return on 62000

- if i make $62,000 how much tax refund

- tax return on $62,000

- 62500 a year is how much biweekly after taxes

- 62000 salary

- federal income tax on $62,000

- 62000 after taxes california

- federal income tax on 62000

- how much a year is 5000 a month after taxes

- how much is 60 000 a year per month after taxes

- how much is 200k a year after taxes

- $62,000 salary

- 62000 a year is how much a month after taxes california

- if i make 62000 how much tax refund

- how much federal tax on $62,000

- how much is 6000 a month after taxes

- how much federal tax on 62000

- how much is $30 000 a year after taxes

- how much is 62 000 a year after taxes

Information related to the topic 62000 a year is how much a month after taxes

Here are the search results of the thread 62000 a year is how much a month after taxes from Bing. You can read more if you want.

You have just come across an article on the topic 62000 a year is how much a month after taxes. If you found this article useful, please share it. Thank you very much.