Let’s discuss the question: how much tax does mcdonald’s take out of your paycheck. We summarize all relevant answers in section Q&A of website Abettes-culinary.com in category: MMO. See more related questions in the comments below.

How much taxes does McDonald’s take out of your check?

10 answers. 10% was taken out of my checks for taxes.

How much is taxes at mcdonalds?

…

Compare MCD With Other Stocks.

| McDonald’s Annual Income After Taxes (Millions of US $) | |

|---|---|

| 2021 | $7,545 |

| 2020 | $4,731 |

| 2019 | $6,025 |

| 2018 | $5,924 |

How To Calculate Federal Income Taxes – Social Security \u0026 Medicare Included

[su_youtube url=”https://www.youtube.com/watch?v=ieA-bmoFk3k”]

Images related to the topicHow To Calculate Federal Income Taxes – Social Security \u0026 Medicare Included

What percent gets taken out of your paycheck for taxes?

| Gross Paycheck | $3,146 | |

|---|---|---|

| Federal Income | 15.22% | $479 |

| State Income | 4.99% | $157 |

| Local Income | 3.50% | $110 |

| FICA and State Insurance Taxes | 7.80% | $246 |

How much do you get paid every two weeks at McDonald’s?

How much does McDonald’s pay every two weeks? At company-owned branches, a newbie starts their job with $11 per hour. In-store shift managers can also earn $15 at the beginning and up to $20 later. Besides, due to shifts, the working hours are not fixed.

How much does a 17 year old get paid at mcdonalds?

Starting pay rate: Age 16-17 – £6.50, age 18-20- £7.25, age 21-24 – £8.72 , age 25 + – £8.72. Shift Pattern: Fully flexible. Starting pay rate: £8.72. Shift Pattern: Fully flexible.

How much is tax usually?

The average tax rate for taxpayers who earn over $1,000,000 is 33.1 percent. For those who make between $10,000 and $20,000 the average total tax rate is 0.4 percent. (The average tax rate for those in the lowest income tax bracket is 10.6 percent, higher than each group between $10,000 and $40,000.

Does McDonald’s pay federal taxes?

McDonald’s appears to have structured its global its global business to avoid paying taxes both in the U.S. and in many of its major markets around the world.

How is tax calculated on food?

Multiply your sales tax rate by the sum total of all the taxable items sold during the month. For example, it your tax rate is 10 percent, and you sold $1,000 in total taxable meals and beverages, the sales taxes due is $100. If correctly collected, you should have taken in $1,100 from customers for these sales.

How do u calculate tax?

Multiply the cost of an item or service by the sales tax in order to find out the total cost. The equation looks like this: Item or service cost x sales tax (in decimal form) = total sales tax. Add the total sales tax to the Item or service cost to get your total cost.

What is $1200 after taxes?

$1,200 after tax is $1,200 NET salary (annually) based on 2022 tax year calculation. $1,200 after tax breaks down into $100.00 monthly, $23.00 weekly, $4.60 daily, $0.58 hourly NET salary if you’re working 40 hours per week.

How much taxes do they take out of a 900 dollar check?

You would be taxed 10 percent or $900, which averages out to $17.31 out of each weekly paycheck. Individuals who make up to $38,700 fall in the 12 percent tax bracket, while those making $82,500 per year have to pay 22 percent.

How much taxes do they take out of $1000?

Paycheck Deductions for $1,000 Paycheck

For a single taxpayer, a $1,000 biweekly check means an annual gross income of $26,000. If a taxpayer claims one withholding allowance, $4,150 will be withheld per year for federal income taxes. The amount withheld per paycheck is $4,150 divided by 26 paychecks, or $159.62.

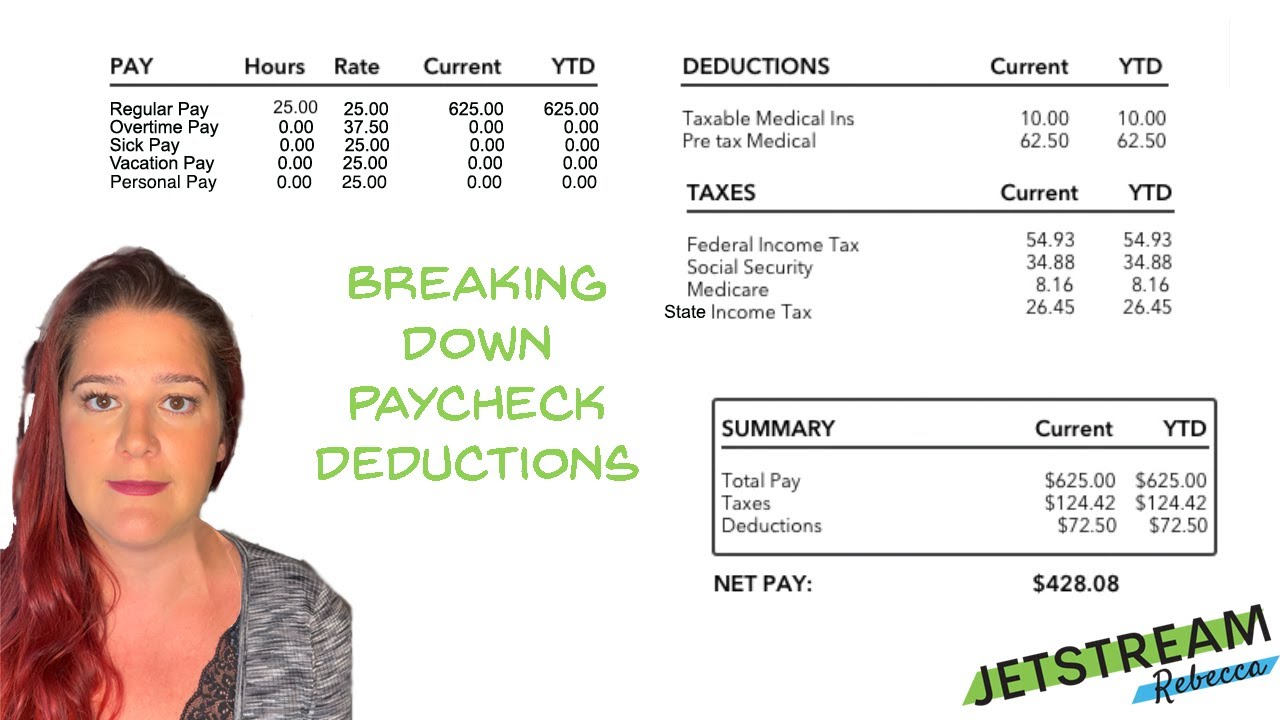

What is Taken Out of My Paycheck? Paycheck Deductions + Payroll Taxes

[su_youtube url=”https://www.youtube.com/watch?v=uDz023pfmhY”]

Images related to the topicWhat is Taken Out of My Paycheck? Paycheck Deductions + Payroll Taxes

Does McDonald’s hold first paycheck?

Like most companies, McDonald’s does hold back your first paycheck. This means you get paid for the work you did the week before. Additionally, if you just started working at McDonald’s, you’ll get paid next week for the hours you’ve put in your first week if that’s when the bi-weekly pay period ends.

Does Mcdonalds offer instant pay?

The daily pay solution provided by Instant is simple from the employee side. After completing a shift there’s a four-hour time frame where 50 per cent of the employee’s earned wage can be taken at no cost through the Instant app.

How many hours do McDonald’s employees work a day?

They work five days a week, which is an average of 25-30 hours per week. In fact, we discovered that McDonald’s actually limits the number of hours an employee can work to only 40 hours per week. For the longest time, McDonald’s starting salary was US$6.25 per hour.

How much profit do McDonalds make a day?

On average, McDonalds makes $75 million revenue in a day! With a turn over of $27 billion annually, it is the 90th largest economy in the world!

How many hours do you work at McDonald’s?

McDonald’s currently has shifts available from four hours to 10 hours throughout the day, to suit the preference and availabilities of employees. There are full or part-time roles with either flexible hours available.

How many hours can you work at 16?

Young people aged 16 and 17 can work a maximum of 8 hours a day, up to 40 hours a week. If the young worker is under 18 and works for more than one employer, their combined daily or weekly hours cannot exceed the maximum number of hours allowed.

What are the taxes on $100 000?

If you make $100,000 a year living in the region of California, USA, you will be taxed $24,822. Your average tax rate is 15.01% and your marginal tax rate is 24%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

How much tax do I pay on $250000?

| $250,000.00 | $90,519.56 | 36.21% |

|---|---|---|

| Gross Yearly Income | Yearly Taxes | Effective Tax Rate |

How much is tax in the US on food?

In most cases, grocery items are exempt from sales tax. An exception, however, is “hot prepared food products,” which are taxable at California’s 7.25% state sales tax rate plus the local district tax rate (see rates here), whether they’re sold to-go or for consumption on the store premises.

How much tax does McDonald’s pay in UK?

Filings with Companies House show McDonald’s paid £75m in UK corporation tax last year, up from £64.9m in 2017. It made pre-tax profits of £406.3m, up from £341m in 2017, despite a slide in sales of almost £80m to £1.5bn.

Jaw-Dropping McDonald’s Paycheck | This is Life on a Minimum Wage Budget

[su_youtube url=”https://www.youtube.com/watch?v=lHHe1qXzBE4″]

Images related to the topicJaw-Dropping McDonald’s Paycheck | This is Life on a Minimum Wage Budget

How much tax does McDonald’s pay in Australia?

In previous years the company has indicated this is a royalty fee. By paying that fee offshore, the company’s Australian income tax bill was reduced to $120.4 million (slightly down from $132.7 million in 2019). Profit after income tax was $206.4 million (down from $302.8 million in 2019).

How can I get my Mcdonalds W2 online?

To get your pay stubs or print out your W2’s, log on to the employee portal. Your log on information is your last name with the first letter capitalized, your first initial capitalized and the last 4 digits of your social security number. Your password will be the last 6 digits of your social security number.

Related searches

- how much tax does mcdonald’s take out of your paycheck

- how does mcdonald’s pay their employees

- how much tax does mcdonald’s charge

- how much do mcdonald’s take out for taxes

- do minors get taxes taken out of their paycheck

- how much is tax on food at mcdonalds

- estimate how much taxes will be taken out of my paycheck

- how much does mcdonald’s pay in hawaii

- how does mcdonalds pay their employees

- how much is tax at mcdonalds

- how much does mcdonalds pay in hawaii

- how much tax is deducted from a paycheck mcdonalds

- how much does mcdonald’s take out of your paycheck

- how much tax does mcdonalds charge

- how much did mcdonalds pay in taxes 2020

Information related to the topic how much tax does mcdonald’s take out of your paycheck

Here are the search results of the thread how much tax does mcdonald’s take out of your paycheck from Bing. You can read more if you want.

You have just come across an article on the topic how much tax does mcdonald’s take out of your paycheck. If you found this article useful, please share it. Thank you very much.